The cryptocurrency industry has evolved rapidly in recent years, giving rise to a variety of types of crypto exchanges that cater to different trading needs and business goals. For anyone planning to launch a crypto exchange, one of the first and most critical decisions is selecting the right exchange model. The three main types of crypto exchanges are Centralized Exchanges (CEX), Decentralized Exchanges (DEX), and Hybrid Exchanges.

Each type offers distinct advantages and limitations, and understanding these differences is key to making an informed business decision. This article explores how each exchange model works and which one aligns best with your business objectives.

Types of Crypto Exchanges Explained: Centralized (CEX)

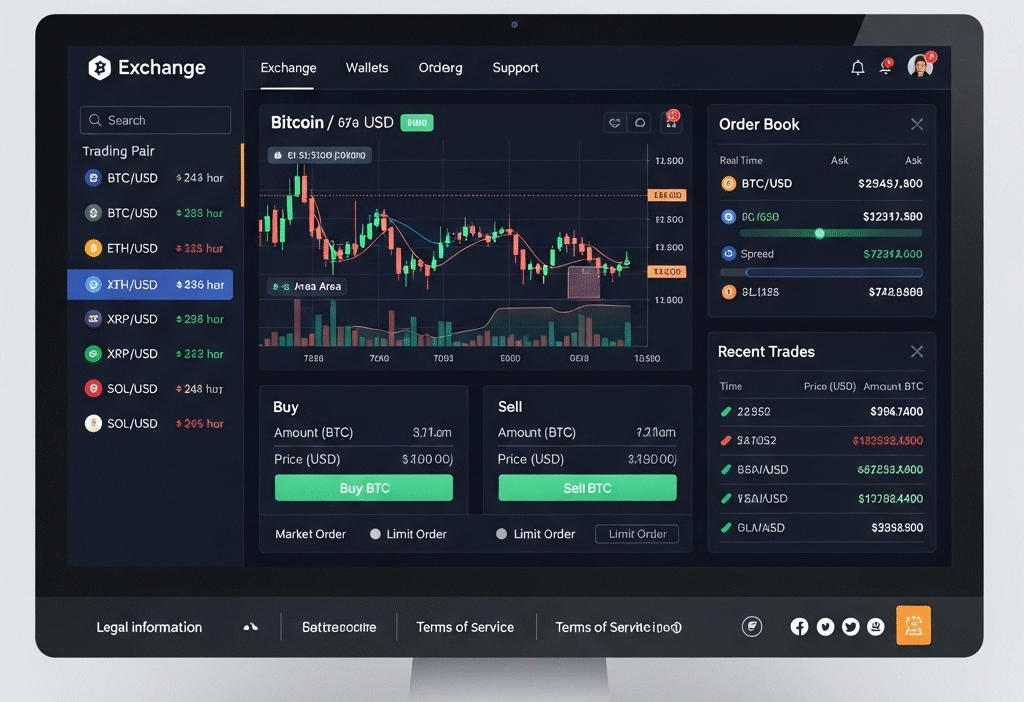

Centralized exchanges are platforms operated by a central authority that facilitates crypto trading by managing order books, user accounts, and liquidity. Examples include Binance, Coinbase, and Kraken.

Key Characteristics:

- User-friendly interfaces

- High liquidity and trading volumes

- Fiat on-ramps for wider accessibility

- Regulatory compliance and KYC processes

- Custodial wallets managed by the platform

Centralized exchanges are ideal for entrepreneurs who want to offer a robust, fast, and scalable trading experience with direct control over user activity and security protocols.

However, since user funds are held in custody, they are also exposed to higher risks in the event of a security breach. It’s crucial to invest in advanced security measures and compliance frameworks when opting for this model.

Types of Crypto Exchanges: Decentralized (DEX) Overview

A decentralized exchange enables peer-to-peer (P2P) trading through blockchain smart contracts, eliminating the need for intermediaries. Well-known DEXs include Uniswap and PancakeSwap.

Key Characteristics:

- Non-custodial (users retain control of their funds)

- Transparent and trustless transactions

- Lower regulatory oversight

- Often integrated with DeFi protocols

DEXs empower users with more privacy and control but often suffer from lower liquidity, slower trade execution, and limited fiat compatibility. For startups focused on decentralization and privacy, especially in emerging markets, DEX platforms can be a strong foundation.

If you’re exploring P2P crypto exchange development, the DEX model provides a decentralized infrastructure that minimizes third-party control while maximizing transparency.

Hybrid Types of Crypto Exchanges: Combining CEX and DEX

Hybrid exchanges are designed to merge the benefits of CEX and DEX platforms. They offer the liquidity, speed, and usability of centralized platforms along with the security and transparency of decentralized systems.

Key Characteristics:

- High-performance trading engine

- Partial or full non-custodial features

- Improved security with user-controlled assets

- Reduced risk of centralized failure

- Greater trust through blockchain transparency

Hybrid exchanges are gaining popularity among founders who want to serve both institutional and retail users with a reliable and secure trading environment.

Given the development complexity, this model requires a clear architectural plan and advanced blockchain knowledge. If you’re aiming to deliver a modern, scalable platform, hybrid crypto exchange development is worth considering.

Which Crypto Exchange Model Fits Your Business?

Choosing the right model depends on multiple factors, including target audience, geographical reach, compliance goals, and technical expertise. Here’s a quick comparison:

Below is a quick comparison of the most common types of crypto exchanges, highlighting their strengths and trade-offs.

| Feature | CEX | DEX | Hybrid |

|---|---|---|---|

| Custody of Funds | Platform-held | User-held | Mixed |

| Liquidity | High | Variable | High |

| Regulatory Compliance | High | Low to moderate | Balanced |

| Speed & Performance | Fast | Slower | Fast |

| User Privacy | Moderate | High | High |

Understanding these nuances is crucial, especially when estimating the crypto exchange development cost, timeline, and compliance needs.

If you’re still unsure about the best direction, it’s helpful to learn more about how to create a crypto exchange from the ground up, and the critical elements involved in building a secure and scalable platform.

Conclusion

Understanding the pros and cons of the various types of crypto exchanges helps you align your platform with your business model, security needs, and user expectations. The type of crypto exchange you choose to build will shape your business model, user experience, and long-term growth. Centralized exchanges offer ease of use and liquidity, decentralized exchanges provide autonomy and transparency, while hybrid exchanges attempt to combine the best of both.

Carefully evaluate your business goals, regulatory landscape, and technical capabilities before choosing a path. Whether you’re building a fully regulated CEX or exploring a decentralized P2P platform, aligning your strategy with your market needs is key to long-term success. Whether you’re building a fully regulated CEX or exploring a decentralized P2P platform, choosing the right type of crypto exchange from the many types of crypto exchanges available is key to aligning your strategy with long-term market success.

Related Article – Why 2025 Is the Perfect Time to Launch a Crypto Exchange