In today’s fast-paced world, managing shared expenses with friends, family, or roommates can be cumbersome. Apps like Splitwise have gained immense popularity by simplifying bill splitting, ensuring transparency, and keeping track of who owes whom. Developing a bill-splitting app similar to Splitwise is an excellent opportunity for tech startups or businesses looking to offer practical solutions in the fintech space.

In this article, we will guide you through the process of Splitwise like app development, discuss essential features, the tech stack, and the overall steps needed to create an app like Splitwise.

Why Build a Bill Splitting App?

Bill-splitting apps are essential tools for managing expenses, making life easier for users who share costs. Whether it’s splitting rent, utility bills, or restaurant expenses, users can keep track of their finances seamlessly.

Key benefits of building a bill-splitting app:

- Simplifies shared expenses

- Keeps financial transparency among users

- Reduces the hassle of manual calculations

- Promotes healthy financial relationships between friends or roommates

- Provides a potential revenue stream through in-app advertisements, premium features, or transaction fees.

With the global rise in fintech apps, developing a Splitwise-like app offers not only business value but also a user-centric solution for a growing digital-savvy audience.

Step-by-Step Guide to Splitwise-like App Development

Creating a successful app requires strategic planning, technical development, and an understanding of user needs. Below is a detailed guide on how to develop a bill-splitting app like Splitwise.

1. Market Research and Target Audience Identification

Before you begin development, it’s crucial to understand the market landscape and your target audience. Analyze existing competitors like Splitwise, Settle Up, and Tricount. Focus on:

- What features they offer

- How they solve user problems

- User feedback on app stores (e.g., common complaints or feature requests)

Define your target audience. Are you building the app for college students, roommates, families, or corporate groups? Understanding who will use the app helps in designing user-centric features.

2. Define the Core Features of the App

A bill-splitting app like Splitwise needs a set of core features to provide value to users. Here are the must-have features for Splitwise-like app development:

- User Registration and Profile Creation: Enable users to sign up using their email, phone numbers, or social media accounts. Ensure the ability to create and customize profiles.

- Create Groups: Allow users to create groups for shared expenses, such as for roommates or travel companions.

- Expense Logging: Users should be able to log expenses with details like the payer, amount, and reason for the expense.

- Automatic Calculation: The app should automatically calculate how much each group member owes.

- Debt Tracking: Keep a real-time record of how much each person owes or is owed.

- Expense Settlement Options: Include multiple options for settling debts, such as bank transfers, PayPal, Venmo, or other payment gateways.

- Notification System: Notify users when new expenses are added or when debts are settled.

- Expense History: Users should be able to view their transaction history, grouped by months, groups, or categories.

- Currency Converter: If you aim to reach a global audience, a currency converter is crucial for international travel groups.

- Reports and Analytics: Provide insights into spending habits and patterns through graphs or summaries.

These features form the foundation of your Splitwise-like app and ensure users get a smooth, hassle-free experience managing their shared finances.

3. Choose the Right Tech Stack

Your tech stack will depend on the features and scalability you envision for the app. Below is a typical tech stack for Splitwise-like app development:

- Frontend (User Interface):

- iOS: Swift or Objective-C

- Android: Kotlin or Java

- Cross-platform: React Native or Flutter

- Backend (Server-side Logic):

- Node.js with Express

- Python with Django or Flask

- Ruby on Rails

- Database:

- PostgreSQL or MySQL for structured data

- MongoDB for unstructured data

- Payment Gateways:

- PayPal API

- Stripe API

- Venmo API

- Cloud Hosting:

- AWS or Google Cloud for reliable cloud storage and hosting

- Real-time Notifications:

- Firebase or Twilio

Choosing the right tech stack ensures the app performs efficiently, provides scalability, and offers security.

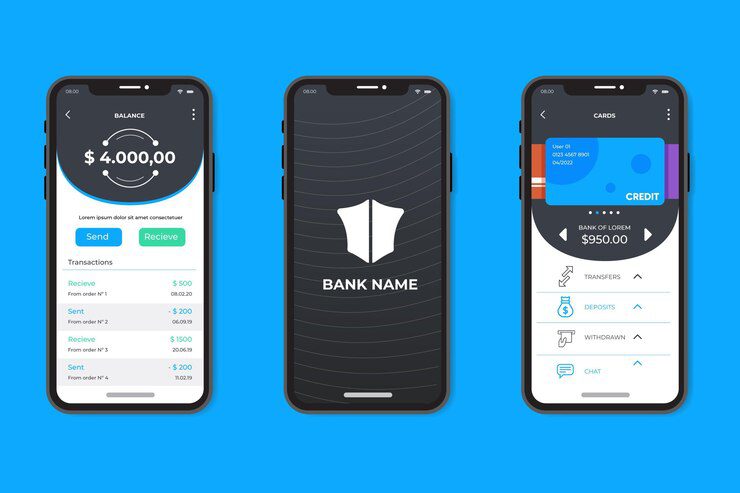

4. Design the User Interface (UI) and User Experience (UX)

For any successful app, a seamless user interface and experience are crucial. Focus on building a clean, intuitive UI that makes it easy for users to add expenses, create groups, and track payments. Use professional design tools such as Sketch, Figma, or Adobe XD to create your app’s wireframes and prototypes.

Important UI/UX considerations:

- Simplified Navigation: Users should be able to perform tasks like adding expenses or settling debts with minimal effort.

- Minimalistic Design: A clutter-free, clean design improves user engagement and satisfaction.

- Responsiveness: Ensure your app works smoothly on devices of all sizes.

5. Develop and Test the App

Once you have the design and tech stack ready, it’s time to build the app. Break down the development process into two stages: frontend and backend.

- Frontend Development: Implement the user interface, navigation, and interactions for the app.

- Backend Development: Work on the server-side logic, such as user authentication, data management, and real-time sync between devices.

Once the app is developed, it’s essential to perform thorough testing. You’ll need to test the app for:

- Functionality (ensuring features work as expected)

- Usability (ensuring user-friendliness)

- Performance (ensuring quick response times and smooth performance)

- Security (ensuring user data is protected from breaches)

Beta testing with real users can offer valuable insights before the official launch.

6. Launch and Market the App

Once your app has gone through rigorous testing, it’s ready to launch. Publish the app on Google Play Store and Apple App Store, ensuring you comply with their submission guidelines.

Marketing strategies to boost app downloads include:

- Social Media Campaigns: Use Instagram, Facebook, and Twitter to create awareness.

- App Store Optimization (ASO): Optimize your app’s title, description, and keywords to improve visibility on app stores.

- Referral Programs: Offer users incentives to refer the app to friends, which helps increase the user base.

7. Monetization Strategy

Once your app gains traction, monetization can be introduced through:

- In-app Advertisements: Partner with ad networks to display relevant ads to users.

- Freemium Model: Offer basic features for free but charge for premium features, such as ad-free usage or advanced reporting.

- Transaction Fees: Charge a small fee for financial transactions made through the app.

Conclusion

Building a bill-splitting app like Splitwise involves understanding your target audience, focusing on essential features, selecting the right tech stack, and ensuring a seamless user experience. By following these steps, you can successfully create an app like Splitwise and enter the competitive fintech space. With proper marketing and a solid monetization strategy, your app can provide immense value to users while generating revenue for your business.

FAQs

1. How much does it cost to develop a Splitwise-like app?

The cost of developing a bill-splitting app depends on various factors such as the features, platform (iOS/Android), development time, and the region where the developers are based. A basic app version can cost between $25,000 and $50,000, while a more advanced app with additional features can go up to $100,000 or more.

2. What features should I include in a bill-splitting app?

Key features include user registration, group creation, expense logging, automatic calculation of amounts owed, payment integration, debt tracking, notification systems, and expense history tracking.

3. How can I monetize a bill-splitting app?

Common monetization methods include in-app advertisements, premium features (freemium model), and transaction fees for payments made within the app.