Dubai, a vibrant financial market in the Middle East, offers a plethora of opportunities for investors looking to diversify their portfolios. Whether you’re a seasoned investor or a novice, selecting the right stock broker is crucial to your investment success. But with so many brokers offering their services, how do you decide which one is best suited for your investment goals? Here we explore key points to consider when choosing the right stock broker in Dubai.

Understand Your Investment Needs

Before diving into the vast sea of available brokers, clearly define your investment objectives. Are you looking for long-term growth, or are you more interested in short-term gains? Do you prefer a hands-off approach, or do you want to actively manage your investments? The answers to these questions will help guide your search for the ideal broker.

Consider the Range of Services

Stock brokers in Dubai offer a range of services, from basic execution of trades to comprehensive financial advice and portfolio management. Some specialize in certain investment products, while others offer a broad spectrum of options like stocks, bonds, mutual funds, and ETFs. Ensure the broker you choose can cater to your specific needs and provides access to the investments you’re interested in.

Evaluate the Broker’s Regulatory Compliance

In Dubai, stock brokers are regulated by the Securities and Commodities Authority (SCA) and possibly other global regulatory bodies if they operate internationally. It’s imperative to choose a broker that adheres to strict regulatory standards to ensure the safety and security of your investments. Check the broker’s licensing and compliance history to avoid potential scams or unethical practices.

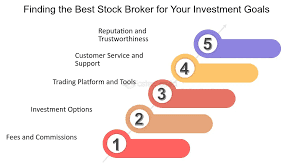

Assess Fees and Commissions

Fees can eat into your investment returns, so it’s vital to understand the cost structure of any broker you’re considering. Some brokers charge a flat fee per trade, while others may offer commission-free trades but charge monthly service fees. Additionally, be on the lookout for hidden fees, such as inactivity charges or withdrawal fees. Compare fee structures across several brokers to find the most cost-effective option for your trading activity level and investment style.

Look at the Trading Platform and Tools

The broker’s trading platform is your gateway to the markets, so it should be user-friendly, reliable, and equipped with the tools you need to make informed decisions. Many brokers in Dubai offer demo accounts, allowing you to test their platforms before committing. Check for real-time market data, technical analysis tools, and educational resources to enhance your trading experience.

Customer Support

Excellent customer service can significantly enhance your investing experience, especially when you need quick assistance with your account or trades. Look for brokers that offer multiple channels of support, such as live chat, email, and phone. It’s also worth checking reviews to gauge the broker’s responsiveness and the quality of their customer service.

Read Reviews and Testimonials

Learning from other investors’ experiences can provide valuable insights into a broker’s reputation and reliability. Look for independent reviews and testimonials on financial forums, social media, and review websites. While no broker will have a perfect record, consistent positive feedback is a good indicator of quality service.

Conclusion

Choosing the right stock broker is a personal decision that should align with your investment goals, preferences, and financial situation. By considering the key points outlined above, you can narrow down your options and select a broker that will be a valuable partner in your investment journey in Dubai. Remember, taking the time to research and select the right broker can have a significant impact on your investment success.

Navigating the financial markets can be complex, but with the right broker, you’ll be well-equipped to achieve your investment objectives. Start your journey today by carefully considering what you need from a broker and evaluating the options available in Dubai.

Choosing the right stock broker is a personal journey that significantly depends on aligning with your unique investment goals, preferences, and financial objectives. Beyond considering the general key points—clear comprehension of investment needs, assessment of the broker’s regulatory compliance, understanding of fee structures, and evaluation of trading platforms and customer service—highlighted above, Orient Finance emerges as a compelling choice within the Dubai financial landscape.